Brogent Maintains Steady Global Outlook Amid Shifting Tariff Policies

News ArchivesApril 06, 2025

As the United States updates its import tariff policies toward certain countries, businesses with global operations are keeping a close watch on potential changes. Brogent Technologies Inc. (5263), a leading provider of immersive entertainment attractions, noted today (April 6) that its well-established global diversification strategy, broad product and service offerings, and strong gross margins position the company to remain competitive in a shifting trade environment.

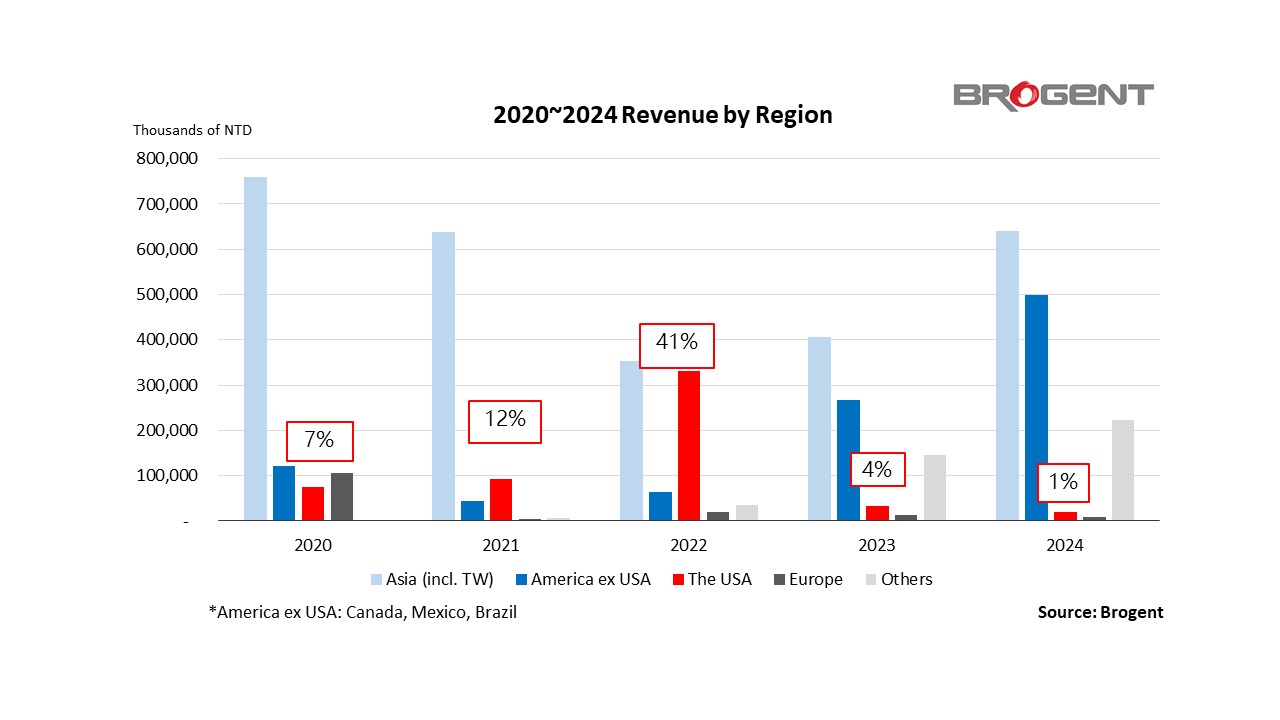

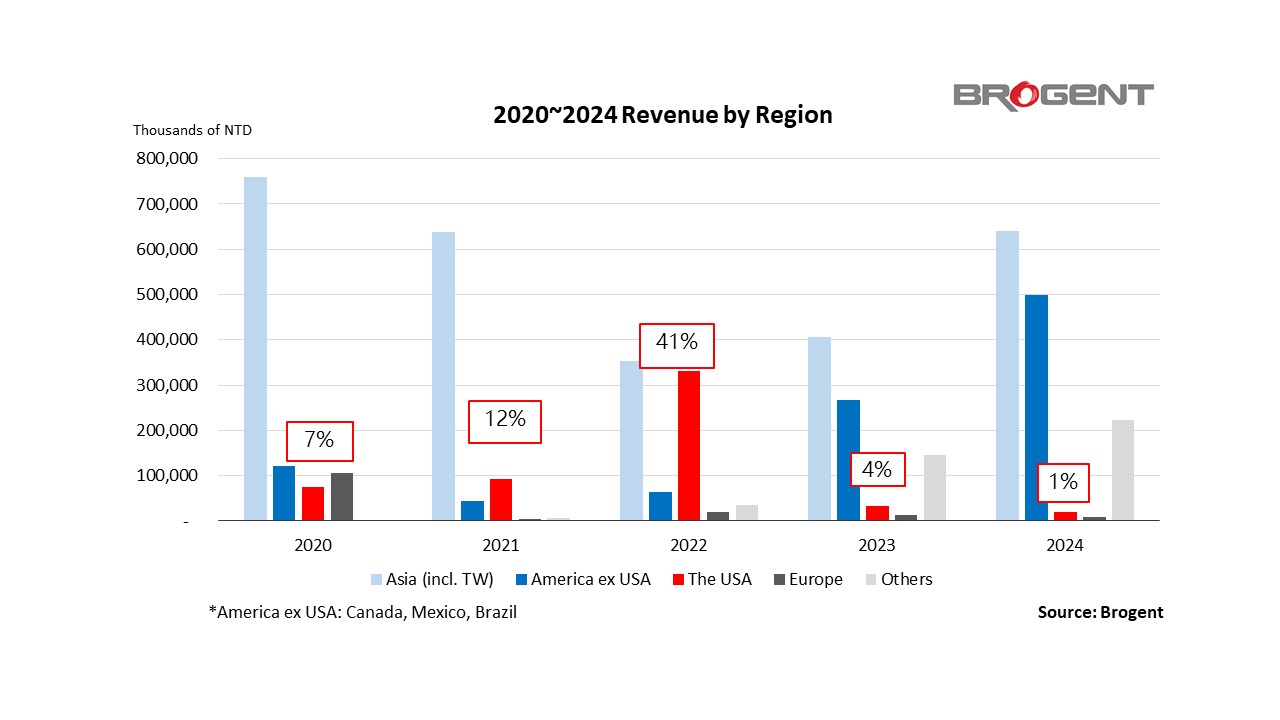

Brogent noted that its immersive ride systems are installed in more than 20 countries and regions, including Canada, Japan, Germany, Mexico, and Saudi Arabia. This broad international presence helps the company maintain a well-balanced market portfolio and reduces exposure to changes in any single region. The U.S. currently accounts for a relatively small share of Brogent’s overall revenue—4% in 2023 and just 1% to date in 2024 (Chart 1). With continued growth in markets such as the Middle East and Asia, Brogent believes the latest adjustments to U.S. tariff policies are unlikely to have a significant impact on its business.

While globally rising tariffs may impact the broader theme park industry by influencing consumer spending patterns, Brogent has responded by diversifying its product offerings to align with the growing demand for more affordable solutions. The company’s compact, cost-effective o-Ride flying theater has already been successfully introduced in Brazil, Japan, and Canada, while its new 4D motion theater is now available in South Korea. Looking ahead, Brogent continues to offer a range of options across different price points and enhance its market presence.

In addition to its hardware sales, Brogent provides a range of turnkey solutions, including film production, animation, digital content licensing, and themed experience design. These services enhance the company’s equipment offerings and contribute to growth in digital content licensing. By working closely with clients, Brogent’s expert themed design team creates tailored environments that add significant value to each project.

With a high-margin business model, Brogent is well-positioned to navigate shifting tariff policies, particularly compared to U.S.-focused competitors. By leveraging its R&D and systems integration expertise, Brogent manufactures key components in Taiwan and sources others locally as needed. These strategies, combined with effective cost management, enable Brogent to maintain competitive pricing in a changing trade environment.

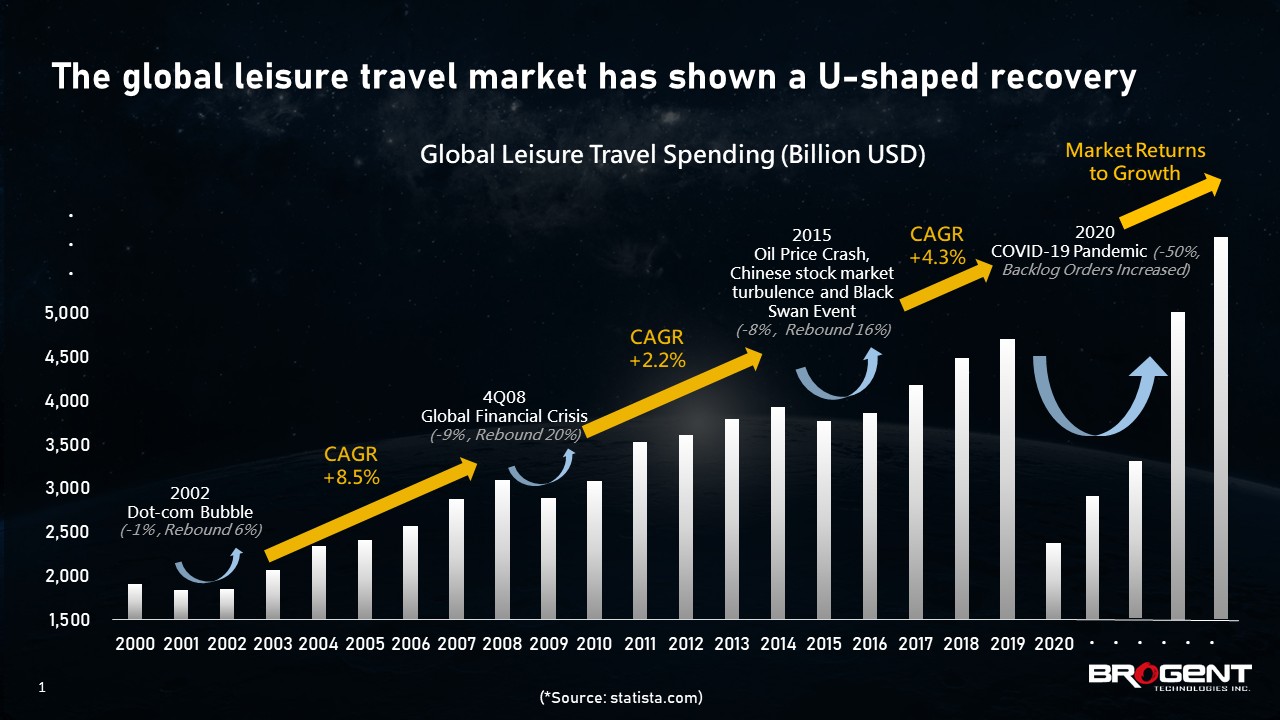

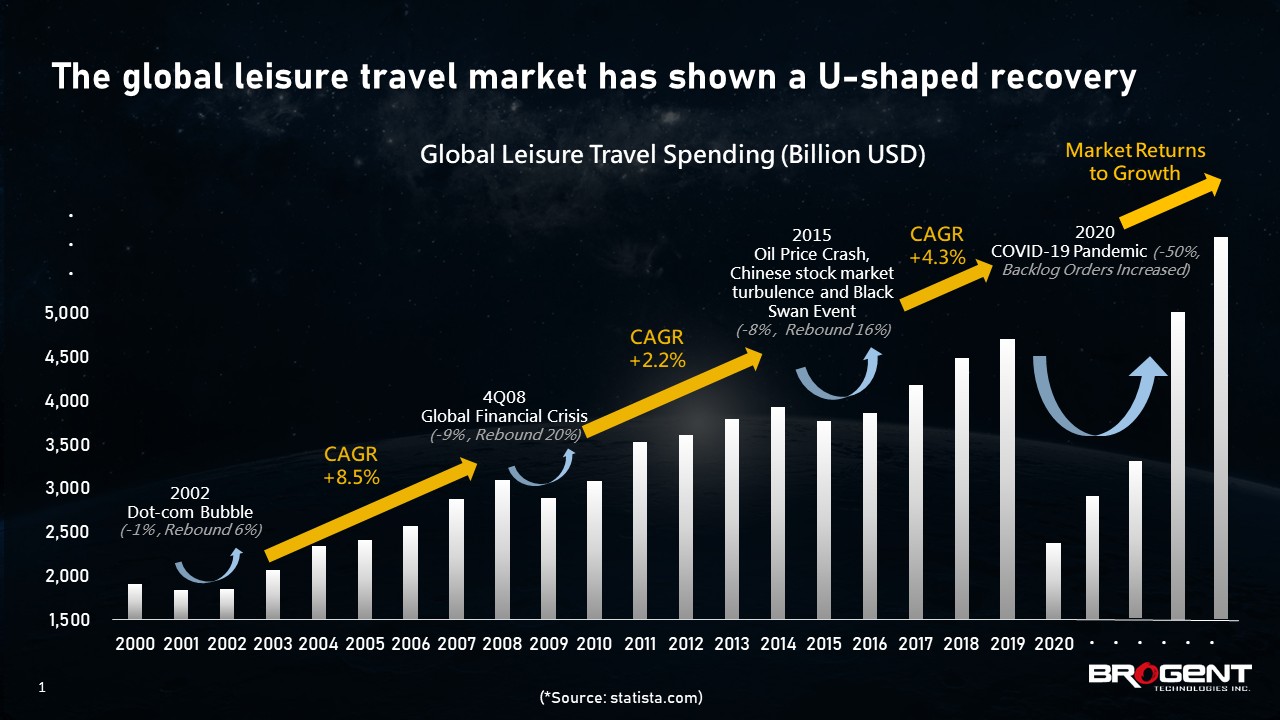

While tariff changes may create challenges for the attractions industry as a whole, Brogent remains confident in the sector's resilience. Historical data (Chart 2) shows that, aside from the 2020 COVID-19 pandemic, the global leisure and tourism market has weathered past disruptions—such as financial crises—with impacts typically not exceeding 10%. Notably, major theme park operators are continuing to invest heavily in their growth: Disney has committed $60 billion to its parks and cruise operations over the next decade, while both Shanghai and Hong Kong Disneyland have announced expansion plans. NBCUniversal is preparing to open Europe’s first Universal Studios in the UK, and the Middle East is advancing its Vision 2030 investment in leisure infrastructure.

As post-pandemic supply shortages continue and demand exceeds supply, Brogent remains optimistic about steady growth in 2025. The company plans to build on its diversified approach and high-margin products to strengthen its position in the global market.

Chart 1: The U.S. currently accounts for a relatively small share of Brogent’s overall revenue—4% in 2023 and just 1% to date in 2024

Chart 2: Historical data shows that, aside from the 2020 COVID-19 pandemic, the global leisure and tourism market has weathered past disruptions—such as financial crises—with impacts typically not exceeding 10%.

Back to listBrogent noted that its immersive ride systems are installed in more than 20 countries and regions, including Canada, Japan, Germany, Mexico, and Saudi Arabia. This broad international presence helps the company maintain a well-balanced market portfolio and reduces exposure to changes in any single region. The U.S. currently accounts for a relatively small share of Brogent’s overall revenue—4% in 2023 and just 1% to date in 2024 (Chart 1). With continued growth in markets such as the Middle East and Asia, Brogent believes the latest adjustments to U.S. tariff policies are unlikely to have a significant impact on its business.

While globally rising tariffs may impact the broader theme park industry by influencing consumer spending patterns, Brogent has responded by diversifying its product offerings to align with the growing demand for more affordable solutions. The company’s compact, cost-effective o-Ride flying theater has already been successfully introduced in Brazil, Japan, and Canada, while its new 4D motion theater is now available in South Korea. Looking ahead, Brogent continues to offer a range of options across different price points and enhance its market presence.

In addition to its hardware sales, Brogent provides a range of turnkey solutions, including film production, animation, digital content licensing, and themed experience design. These services enhance the company’s equipment offerings and contribute to growth in digital content licensing. By working closely with clients, Brogent’s expert themed design team creates tailored environments that add significant value to each project.

With a high-margin business model, Brogent is well-positioned to navigate shifting tariff policies, particularly compared to U.S.-focused competitors. By leveraging its R&D and systems integration expertise, Brogent manufactures key components in Taiwan and sources others locally as needed. These strategies, combined with effective cost management, enable Brogent to maintain competitive pricing in a changing trade environment.

While tariff changes may create challenges for the attractions industry as a whole, Brogent remains confident in the sector's resilience. Historical data (Chart 2) shows that, aside from the 2020 COVID-19 pandemic, the global leisure and tourism market has weathered past disruptions—such as financial crises—with impacts typically not exceeding 10%. Notably, major theme park operators are continuing to invest heavily in their growth: Disney has committed $60 billion to its parks and cruise operations over the next decade, while both Shanghai and Hong Kong Disneyland have announced expansion plans. NBCUniversal is preparing to open Europe’s first Universal Studios in the UK, and the Middle East is advancing its Vision 2030 investment in leisure infrastructure.

As post-pandemic supply shortages continue and demand exceeds supply, Brogent remains optimistic about steady growth in 2025. The company plans to build on its diversified approach and high-margin products to strengthen its position in the global market.

Chart 1: The U.S. currently accounts for a relatively small share of Brogent’s overall revenue—4% in 2023 and just 1% to date in 2024

Chart 2: Historical data shows that, aside from the 2020 COVID-19 pandemic, the global leisure and tourism market has weathered past disruptions—such as financial crises—with impacts typically not exceeding 10%.